Picture yourself in a rainy New York City day, you are stuck in traffic, you are running late for an important meeting, and you are hoping your taxi driver knows some shortcuts. Your eyes constantly switch from your smartphone to the taxi speedometer. A few blocks away from your destination, you are 30 minutes late, and you still need extra time to pay the driver and get the receipt. This delay is most likely your own fault, but the extra time for payment is related to the service. This is only one of the several frictions in taxi customer experience. More specifically, potential frictions can also be experienced in finding the taxi number or a taxi spot, and estimating the total amount you will have to pay.

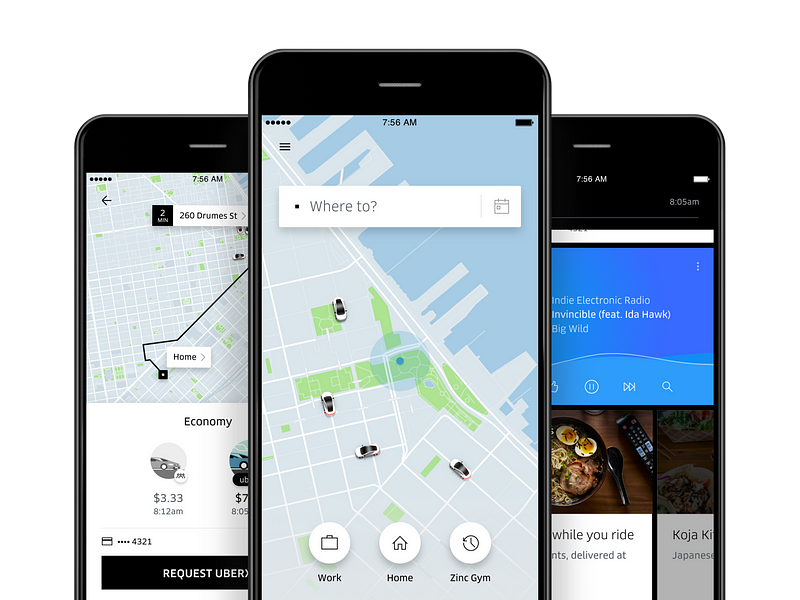

Uber team has worked hard to understand all possible frictions in a taxi-ride experience, in order to come up with solutions to reduce “pain-points.” Designers at Uber look deeply into the mind of their customers, analysing goals, needs and emotions at every step of the way.

The outcome is a faster, smoother and more enjoyable experience, which has helped Uber to rise to a 50$ billion net-worth, more than twice as much as Hearts and Avis combined.

Potential frictions are everywhere: financial services, medical treatments, and travels. Banks and hospitals are only two of the many contexts where functions could be optimized, as Alec Ross, author of Industries Of The Future, points out in his books:

“One person’s friction is another person’s revenue.”

Tech companies release a software update every week, whereas banks and hospitals are running on systems which date back to at least 20–30 years ago. These industries need to understand that their work is strongly linked to technology and they have to act in order to reduce frictions and provide a better service.

Over the last 10 years, a lot of disruptive companies have worked on friction reduction, just like Uber has in the taxi industry. Think of Apple or Spotify in the music industry. Apple created iPod but also generated a service to reduce frictions in finding and storing music. Amazon released Echo, a voice assist device that reduces touch screen-related frictions in order to perform tasks such as playing music or setting up a timer or the desired room temperature.

For most of us, going to the bank is not the most enjoyable experience. It requires considerable time: opening a new bank account, for instance, takes up about 1 hour and involves a lot of boring paperwork.

Millennials are comfortable with online services and N26 has worked hard to switch bank services from physical to digital.

N26 is a Berlin-based startup which allows users to open and check their bank account in just a few minutes, without having to physically go to the bank. This service is the outcome of a deep rethink, not only for the user but also within the company itself. It derives from a meaningful study into every step of the service, aiming at quality optimization and time-waste reduction. People don’t go to the bank because they want to, they go to the bank because they need to.

People are willing to pay more for products or services with fewer frictions. This is why companies invest a lot of money on people who can help create frictionless solutions. This is hard work which requires a strong collaboration between users, stakeholders, and designers.

We are at the edge of the 4th Industrial Revolution, an era which will be remembered for a huge shift from physical to digital, which implies a complete rethink about every process both inside and outside companies.

From a single touch-point all the way to a complex system, this rethink means questioning every aspect of design, marketing, production, promotion, and customer care.

Digitalization is not the challenge. The challenge is the reinvention of every single process.